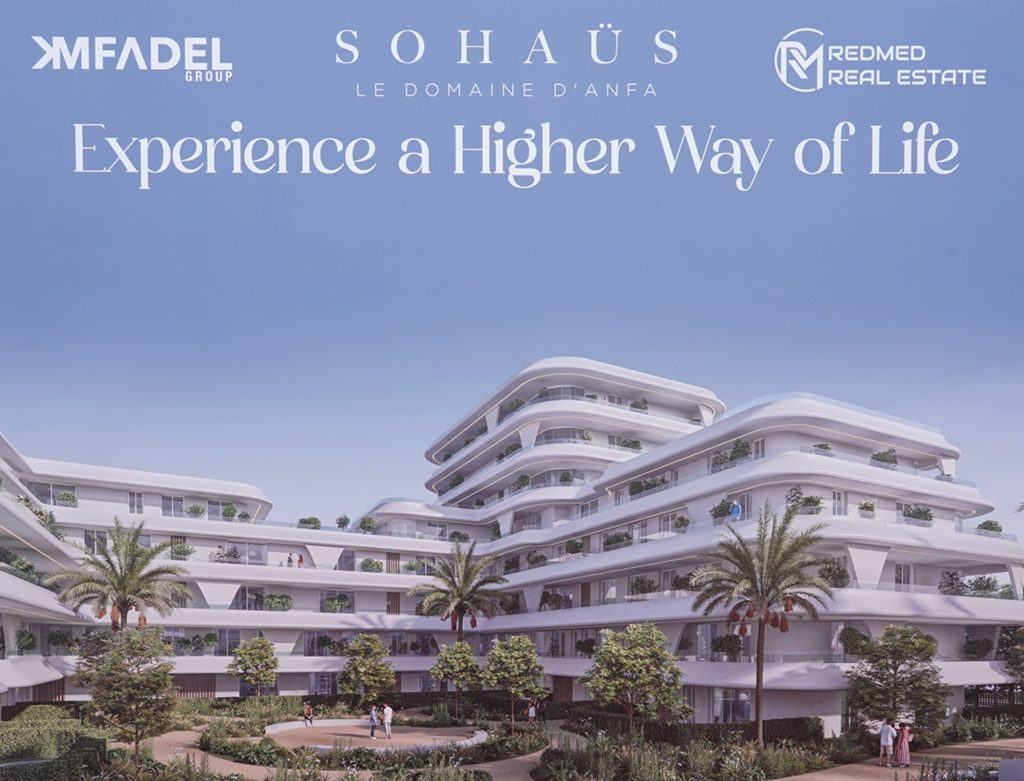

Following a strategic partnership in 2023, the two groups have launched their new “Sohaus” project in Anfa. 300 high-end apartments will be constructed, with prices ranging from 2 million MAD to nearly 10 million MAD. During the launch, the leaders of both partner groups discussed the motivations behind this partnership and confirmed that other projects are already in the pipeline.

The developer Mfadel Group has partnered with Red Med Real Estate (a subsidiary of Red Med Capital) to construct a new project named “Sohaus, Domaine d’Anfa.” This project is the result of the partnership established by the two groups at the end of 2023, with the aim of developing a real estate portfolio.

On May 9, a presentation ceremony was held with the press and major players in the real estate sector to unveil this project, located just two minutes from the Morocco Mall.

900 million MAD investment for nearly 300 high-end apartments

During the event, Yassine Mfadel, CEO of the Mfadel Group, described the scale of the ongoing project. “This project is located in the Domaine d’Anfa, near the ocean and just a few minutes from the Morocco Mall. It’s an exceptional project that will be among the most luxurious in Casablanca due to its location and the development made in line with international standards. There will also be all the nearby amenities, such as the city center currently under development,” he explained.

An investment of 900 million MAD has been allocated to the project. “The investment will enable the construction of nearly 300 high-end apartments, including triplexes, duplexes, apartments, and townhouses,” added the Mfadel Group CEO. Starting prices will “begin at 2 million MAD for a 2-bedroom apartment, reaching around 10 million MAD for individual triplexes,” he revealed.

Beyond this project, other developments are already in the pipeline under the partnership between the two groups.

A partnership to optimize costs and profitability

The collaboration between the two groups, signed in 2023, is based on a strategy of complementarity and financial optimization.

As Abdeslam Ababou, CEO of Red Med Capital, explained: “The collaboration is straightforward. Today, we are working on increasingly complex projects that require greater expertise. The Americans and Europeans have been moving in this direction by combining industry expertise with financial expertise. It’s a natural and complementary alliance that allows the development of large-scale projects with all the necessary expertise, from technical knowledge to financial structuring.”

This complementarity between the two groups is grounded in a strong focus on cost management. “These are very high-end services but offered at competitive prices. There’s rigor in managing all processes, using suppliers at the best costs, etc.,” Abdeslam Ababou explained.

In terms of cost management, the goal is to oversee the project financially at all levels, particularly in optimizing financial burdens. “In any project, there are three major costs: investment, capital expenditure (capex), and operational expenses, including the management of operations and suppliers. Then there’s the financial burden, the cost of financing, which must be optimized. When these three elements are aligned, we achieve the best value for money,” continued the CEO of Red Med Capital.

For Mfadel Group, this represents a new financial model and a new budgetary approach that ensures better profitability of equity in deployed operations.

“The expertise of Red Med Capital is particularly important in budgeting and in the use of innovative performance metrics. To give you an idea, for this project, we’re not just looking at our margin but also at the internal rate of return (IRR), meaning the equity and return on investment over time. This is a new approach for real estate developers and is where the difference lies. If you have a real estate project where you only focus on the margin but it takes ten years to develop with 100% equity, it’s not the same as a project where equity and financial burden are optimized, and the return on investment is short-term,” concluded Yassine Mfadel.

The objective is therefore to achieve greater short-term profitability with well-adapted products that sell quickly.